FREE INSURALEX WEBINAR: Impact of Covid-19 on the Latin American (Re) Insurance Industry (II)

MiamiThis is the second of two unparalleled webinars offering a regional overview about the impact of the Covid-19 on the Latin American (Re) Insurance Industry. This webinar is aimed at and designed exclusively for insurance and reinsurance professionals, as well as (re)insurance intermediaries. Countries covered: Colombia, Costa Rica, Ecuador, Mexico, Panama, Peru and Venezuela. Topics:

COVID-19 and the Global (Re)Insurance Industry – Thinking Ahead

JULY 9 -10TH, 2020 Thursday, July 9th, 2020 (6:00-8:00 Los Angeles / 9:00-11:00 New York / 14:00-16:00 London / 22:00-24:00 Tokyo) Please join our panel of Insuralex legal experts from across the globe for an insightful and forward-looking live webinar on the key impacts that the current COVID-19 pandemic is having and will have

Save the date Insuralex 2020 AGM

Insuralex AGM – 2020 (Zoom) PLEASE SAVE THE DATE FOR OUR ANNUAL GENERAL MEETING JULY 9 -10TH, 2020

FREE Insuralex Webinar: Insurance digital commercialization in Latin America

MiamiDigital commercialization for insurers in Latin America ceased to be a long-term development project to became a top priority to them. It gained special relevance during the year 2020 due to the Covid-19 pandemic, whose effects prevented the insurance market from commercializing its products through the customary mechanisms. As jurisdictions in Latin America have several

Class Action in Europe – developments towards a “new normal” in litigation in light of the directive (EU) 2020/1828?

MadridInsuralex is a group of more than 50 independent law firms Practice areas: from Europe, North America, Latin America, Africa, Asia and the Middle East that specialise in Insurance and Reinsurance. Insuralex firms work for a wide range of clients including insurance and reinsurance companies, Lloyd’s syndicates, insurance and reinsurance brokers as well as captives

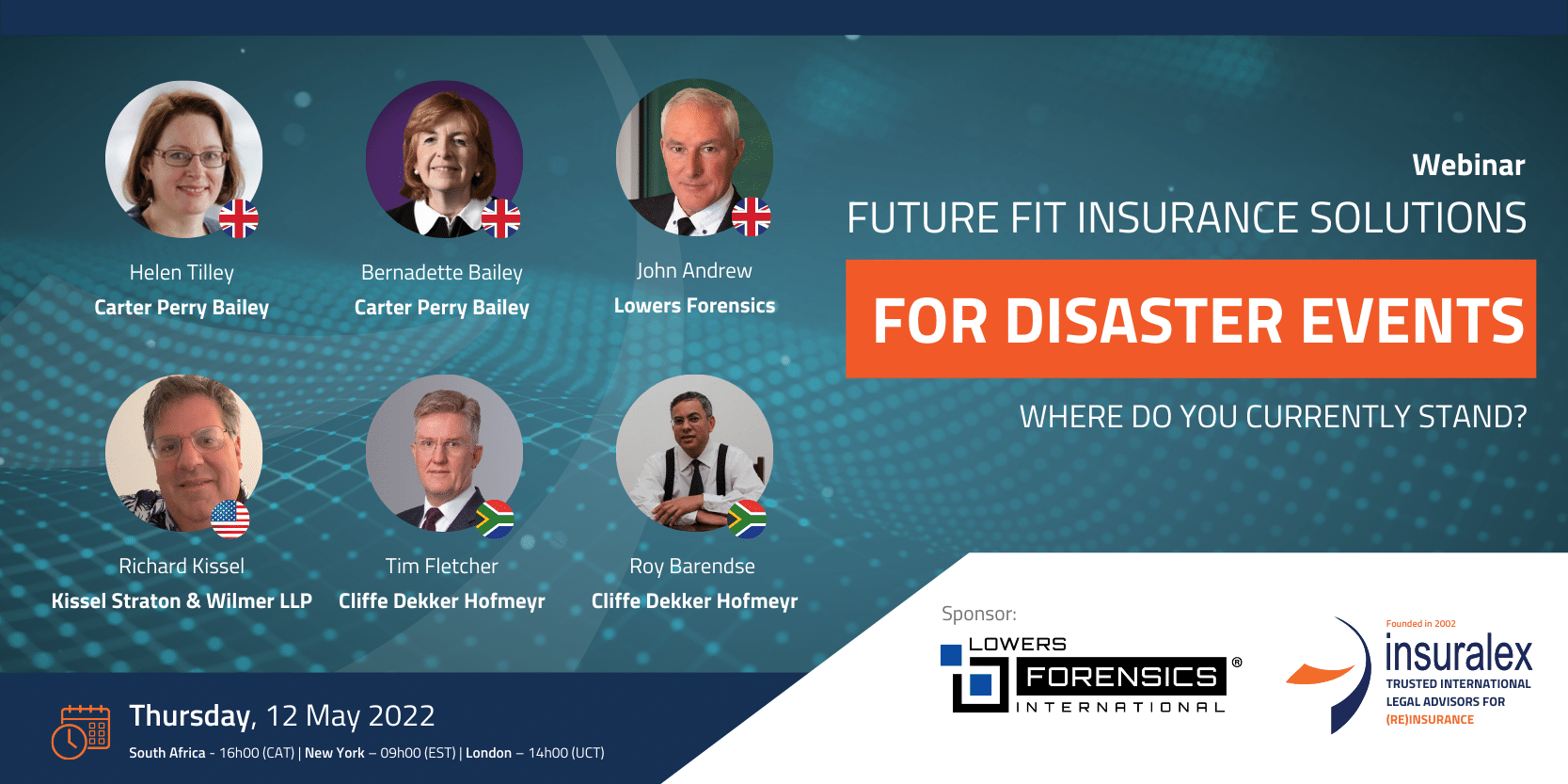

Insuralex international webinar: Future fit insurance solutions for disaster events – where do you currently stand?

https://insuralex.com/2022-insurance-solutions-disaster-events/Please join Insuralex for a discussion on global insurance industry developments following the pandemic with a focus on disaster-related insurance cover. Our team of experts from South Africa, London and New York will unpack court judgments on business interruption losses, the position for brokers in light of possible coverage issues and what the future holds in respect of business interruption

Webinar FIDES & Insuralex: Insurance regulatory update in Latin America

FIDES (Federación Interamericana de Empresas de Seguros) has launched a report on insurance regulatory matters in the countries where FIDES has member insurer associations. FIDES represents 18 Latin American countries as well as Spain and The United States. Topics include: Licensing requirements for setting up insurers Regulatory and financial information Solvency requirements Supervision Distribution channels Reinsurance Investments Microinsurance regulations Cyber risk regulations Technology

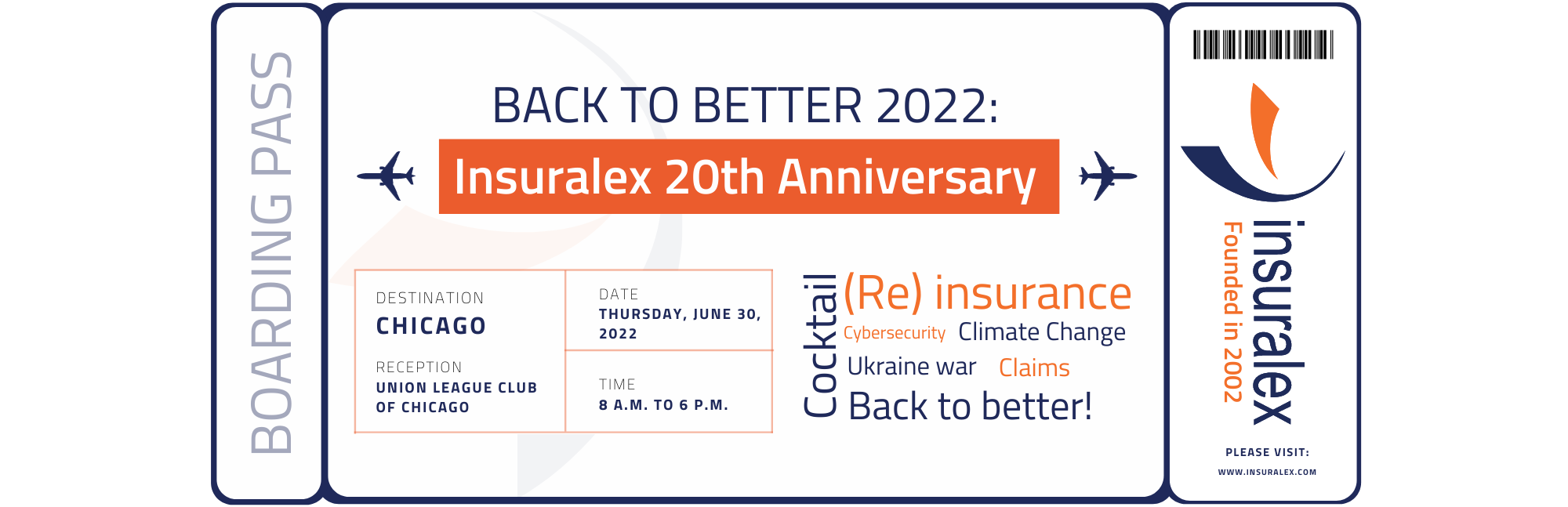

Destination: Chicago “20th Insuralex Forum and Insuralex Annual Meeting”

Your boarding pass is ready. Destination: Chicago “20th Insuralex Forum and Insuralex Annual Meeting” We are so pleased to advise that we are finalizing the details of the Twentieth Annual Insuralex Forum and Insuralex Annual Meeting, at Union League Club of Chicago, Illinois, Thursday, June 30, 2022. With our emergence from the COVID-19 pandemic, we are seeing

Meet us at the 64th Monte Carlo Rendez-vous!

International Members will be attending the 64th Rendez-vous de Septembre from 11 to 14 September 2022 and are very much looking forward to meeting old and new friends at one of the most important events in the international reinsurance calendar. We have been fortunate enough to reserve tables in the Crystal Bar at the

Free Insuralex Webinar. 2022 Parametric Insurance in Latin America: An update

The use of parametric insurance as an alternative to traditional indemnity-based insurance has increased over the last twenty years, particularly as a mechanism for insuring against extreme weather risks. Following said increasement, parametric insurance in Latin America has not received a standardized legal treatment. Every country has developed its applicable normative, at its sole discretion,